Hint, it’s not Personal Injury Lawyers.

If you’ve recently received your car insurance renewal notice and found yourself doing a double-take, you’re not alone. Car insurance rates are surging in 2024, and the reasons might surprise you. From cutting-edge tech in vehicles to Mother Nature’s fury, a perfect storm of factors is driving premiums through the roof. But don’t worry—by understanding these trends, you can take steps to manage your costs.

1. Cars Are Smarter—And More Expensive to Fix

Today’s cars are no longer just vehicles—they’re rolling computers loaded with advanced technology. Features like advanced driver-assistance systems (ADAS), high-tech sensors, and electronic control units are amazing for safety and convenience, but they’re not so great for your wallet when repairs are needed.

A minor fender bender in the past might cost a few hundred bucks to fix. Now? That same accident could rack up thousands in repair bills because of:

- Specialized sensors and cameras that need precise calibration

- Costly electronic components that are difficult to replace

- High-tech materials like carbon fiber and advanced steels requiring specialized techniques

- Higher labor costs for technicians trained in modern vehicle technology.

- Higher Average Car Price: In 2024 the average car price on the streets of the US is $40,000. Totaling out more expensive cars only adds to the rising costs.

Take Teslas, for example. Repairs for these cutting-edge vehicles can be up to 70% more expensive than traditional cars. Unsurprisingly, insurance companies are adjusting premiums to account for these higher costs.

Source – philomathnews.com

2. Extreme Weather Is Wreaking Havoc

Climate change isn’t just an abstract issue—it’s hitting us right where it hurts: our wallets. Severe weather events, have impacted car insurance rates, and are happening more often and with greater intensity, leaving insurers scrambling to cover unprecedented claims. Just look at the stats:

- In 2023, the U.S. faced 28 billion-dollar weather disasters—a staggering increase from previous decades.

- Claims for hail, floods, and wind damage have skyrocketed, particularly in regions prone to extreme weather.

As insurers absorb these costs, they’re passing the financial burden onto policyholders. If you live in an area with frequent storms or flooding, you’ve likely seen the steepest increases.

Source – CBS News

3. Rising Car Thefts and Cybercrime Add Fuel to the Fire

Modern vehicles might be packed with security tech, but criminals are getting smarter too. Car thefts are on the rise, and it’s not just old-fashioned break-ins:

- Hacking vulnerabilities in keyless entry systems are being exploited.

- Sophisticated theft rings are targeting high-value vehicles.

- Parts from stolen cars are fueling a thriving black market.

The FBI reports an 11.2% increase in vehicle thefts in 2022, with losses exceeding $8 billion. In response, insurers are hiking rates for comprehensive coverage and developing cybersecurity policies to combat the threat.

Source – USA Today

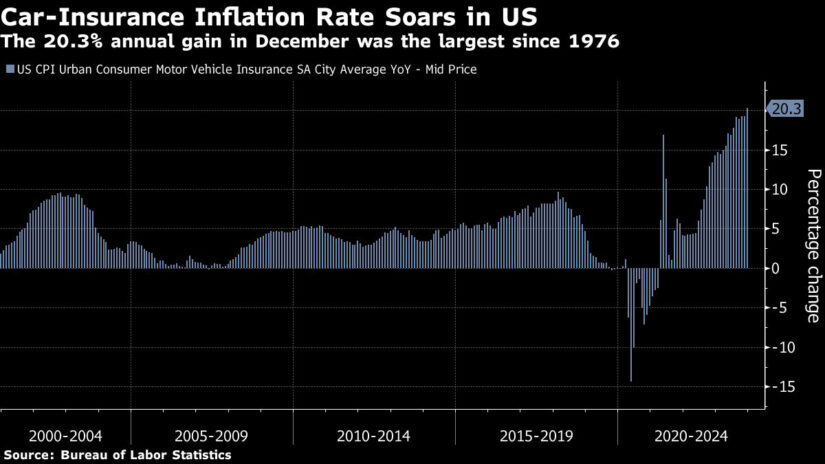

The Bigger Picture: Economic Pressures of Car Insurance Rates

Beyond these key factors, broader economic trends are also pushing rates higher. High interest rates, inflation, and increased operational costs for insurers mean they’re tightening the screws on pricing. Replacement parts, medical expenses, and even administrative costs are climbing, all of which affect what you pay.

How to Keep Your Car Insurance Costs Down

While these trends are daunting, there are ways to protect your budget:

- Drive safely to keep your record clean.

- Increase deductibles to lower premiums.

- Bundle your policies for potential discounts.

- Invest in anti-theft devices to make your car less appealing to criminals.

- Shop around—you might find better rates with another insurer.

Final Thoughts

The rising cost of car insurance in 2024 isn’t random—it reflects real challenges like advanced vehicle tech, climate change, and evolving criminal tactics. While we can’t control these trends, staying informed and proactive can help you navigate this changing landscape. After all, a little preparation today can save you big tomorrow and if you are injured in a car accident, give the Ted Law Firm a call.

Attorney Ted Sink, founder of The Ted Law Firm, is a Yale, Stanford Business School, and Charleston School of Law graduate and former marketing executive who built a 7-figure law practice, earning millions for his clients. With experience in both law and advertising, Ted has been recognized in Forbes, Entrepreneur, and the ABA Journal. He speaks at industry conferences on marketing and law firm management, sharing insights from his unique background to help other firms grow. When not working, Ted enjoys traveling, diving, and dog-sitting golden retrievers.